Many stock markets around the world offer active managers room to generate superior returns. Among them, Japan stands out. Its equity market appears particularly inefficient. Reforms are also shaking up the once stagnant economy, creating new winners and losers in the corporate sector. That said, stockpicking still demands skill and discipline. We believe that managers will need nothing less than exceptional research and a long-term perspective to come out ahead.

Prime Minister Shinzo Abe’s reflationary policies have brought Japan’s stock market to a level of health not seen in decades. Even with the pullback earlier this year, the TOPIX has gained more than 70% in Japanese yen terms since end-2012, when ‘Abenomics’ started raising hopes for Japan’s economic recovery. Investors are rightly interested in gaining exposure to Japan. But how they do so matters.

Adopting a passive strategy may seem attractive. An exchange-traded fund, for instance, would simply track a stock market index in Japan. But why should investors settle for market returns? Japan has traditionally been a stock picker’s market, and it still is. Active managers that are adept at identifying opportunities and managing risks stand a good chance of beating the index over time. The sheer size of Japan’s stock market makes it a fertile hunting ground. It is the third-largest in the world by market capitalisation (US$5.2 trillion) and comprises more than 3,800 listed companies. But there are more reasons why conditions in Japan favour an active approach.

Information advantage

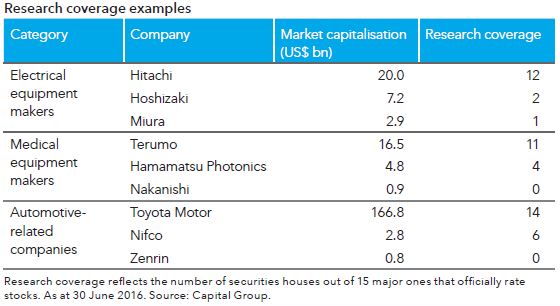

Japan’s stock market appears highly inefficient. Mispricing opportunities can be captured by active managers armed with superior research and insights. What drives stock market efficiency? Research coverage is key. The more analysts there are following a company, the faster information is likely to be shared. In that respect, Japan trails other developed markets like the US and UK significantly. On average, 12 analysts follow each company in the Nikkei 225 index, compared with 22 for the S&P 500 Composite Index and 21 for the FTSE 100 index.1 Research coverage tends to be even thinner for small- and mid-cap companies in Japan (see Exhibit 1). After the global financial crisis, many securities houses cut their research in this space to focus on larger companies instead. Within the electric appliances industry, for example, as many as 12 major securities houses track conglomerate Hitachi. But just two follow commercial kitchen equipment maker Hoshizaki.

Small firms, big reach

Japan’s small- and mid-cap sector is also home to numerous quality companies with leading positions in niche industries. This means there are ample opportunities for extensive bottom-up research to pay off.

Hoshizaki is a case in point. It receives little analyst coverage, yet it dominates the market for ice makers both domestically and abroad. Its energy-saving technology is a key competitive advantage as it eyes a bigger slice of the market for other appliances like refrigerators.

Likewise, few investors may have heard of Sysmex. But it is the world’s leading supplier of blood tests, ranking above healthcare giants such as Abbott. Over the years, Sysmex has gained market share with its highly efficient medical diagnostic tools and is pursuing further growth across various geographies and product lines.

Many small- and mid-cap companies trade at a discount to the market, making them seem even more attractive. But it pays to be careful. Certainly, some companies are undervalued because the market has overlooked them. But there are also those that simply have poor prospects. Active managers make a real difference when they can separate value finds from value traps.

Abenomics effect

In recent years, Abenomics has become a chief driver of investment opportunities in Japan, across companies large and small. Part of the agenda involves long-term reforms that are difficult to price into the stock market. This makes Japan a prime venue for forward-looking stock pickers that can identify companies poised for change.

Already, new corporate governance measures are starting to have an impact. They take aim at low profitability, ineffective boards, and other forms of poor corporate behaviour that have undermined investor confidence for years. Most companies that pledged to adopt these measures have been rewarded by the stock market. But anticipating which companies will do so is no mean feat.

Local insights are critical. Knowing a company’s financials is one thing, but understanding its culture and focus is quite another. It takes on-the-ground research, including regular meetings with top executives, to discern management’s views on Abenomics and detect potential changes in corporate direction.

Some companies that took steps to shape up were once seen as unlikely reform candidates. Fanuc, a world-leading industrial robot maker known for its reticence, surprised the market when it raised its dividend payout ratio and proposed share buybacks last year.

Still, overhauling corporate mindsets across Japan will take time. Its corporate governance still lags behind other developed countries. The discovery of accounting irregularities at electronics group Toshiba last year is a reminder of the gaps that exist. Active managers that can harness research to spot – and avoid – questionable firms have a valuable role to play.

Risk management

Indeed, limiting losses matters. But a passive approach provides no protection in this regard: investors tracking an index fully capture the market’s decline.

Passive investors are also vulnerable to unintended exposures. In February 2011, for example, investors mirroring the MSCI Japan Index would have had a 1.43% exposure to Tokyo Electric Power (TEPCO), whether they were positive about the electricity provider or not. It was then the ninth-largest company in the index. In March 2011, a massive earthquake set off a nuclear disaster at TEPCO’s power plant in Fukushima. As the company sank into the red, its share price plummeted. Today, TEPCO makes up just about 0.19% of the index.

In contrast, an active strategy can better protect against downside. The most successful managers consciously manage their exposures and invest according to their strongest convictions – not the index. They have the flexibility to avoid companies in the index with lofty valuations, or invest in non-index companies that show resilience. They can also hold cash to preserve capital during downturns. In fact, it is often during broad market declines that these managers deliver exceptional value.

Selecting an active manager

Historical data present a compelling case for long-term active investing in Japan. Over five-, 10- and 15-year periods, the median return from Japanese equity active managers handily outpaced the TOPIX (see Exhibit 2). Capital Group’s Japan Equity strategy also beat the TOPIX to rank within the top quartile of the universe over its lifetime.

Of course, not all active managers beat the index in the long term. It is therefore crucial for investors to identify those with the qualities to come out ahead.

Strong research skills are a prerequisite for success, especially in Japan. Given the stock market’s inefficiency, quality research goes a long way towards uncovering attractive opportunities.

This is why we commit huge resources to mine for insights on the ground. Our industry analysts research companies from the bottom up and maintain frequent communication with managements. They monitor not just companies based in Tokyo, but also lesser known firms in other parts of Japan.